Commercial Real Estate Women (CREW) is the industry’s premier business networking organization. Membership offers unparalleled business connections, leadership development opportunities, and access to CREW members in your market and more than 14,000 professionals across the globe.

Learn more about our mission, purpose, and commitment to diversity, equity, and inclusion.

Upcoming Events

View all eventsApr24

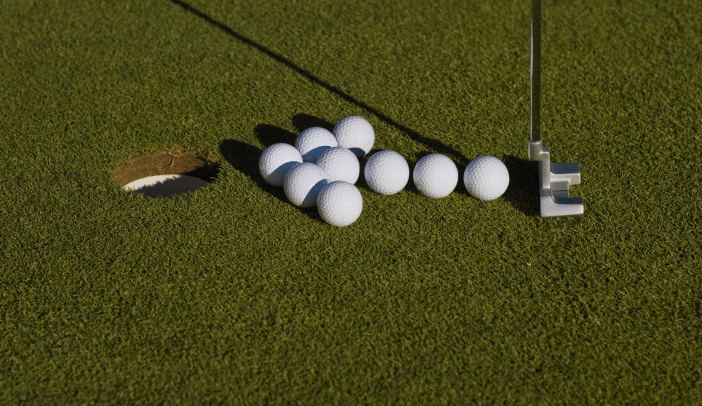

Golf Clinic and Networking

NetworkingMiddlefield, CT, United States

from5:30 PM to - 11:30 PM UTC

Join us at the "tee" for golf and networking.

REGISTER NOW

CREW Network at a glance

Transforming the commercial real estate industry by advancing women globally

14,000+

80+

72%

Membership offers unparalleled business connections, leadership development opportunities, and access to CREW members in your market and more than 14,000 professionals across the globe.